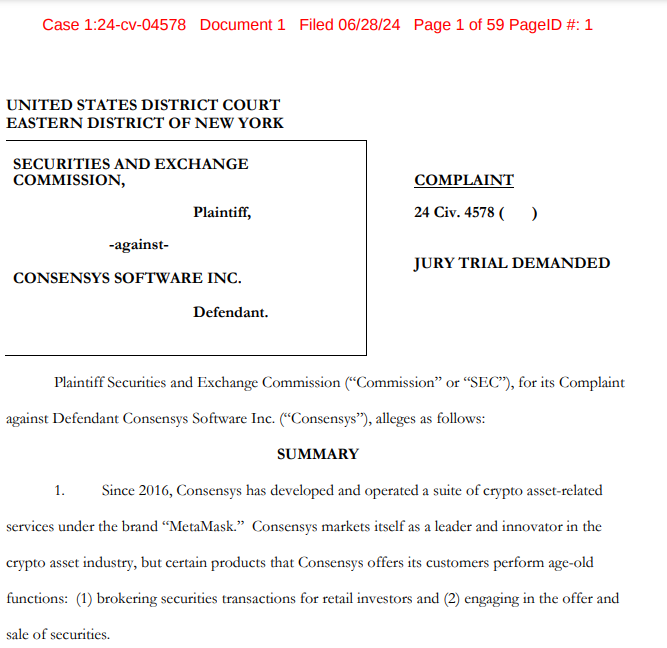

The U.S. Securities and Exchange Commission (SEC) has filed a lawsuit against blockchain software company Consensys, alleging that it acted as an unregistered broker and offered unregistered securities through its MetaMask swaps service and staking programs.

The lawsuit, filed in the U.S. District Court for the Eastern District of New York, claims that Consensys collected over $250 million in fees from activities that should have been registered under federal securities laws.

The SEC alleges that these actions violated federal regulations. In anticipation of SEC actions, ConsenSys filed a preemptive lawsuit in Texas in April. This was preceded by three subpoenas and a Wells notice from the SEC, indicating possible federal securities law violations. Consensys argues that the SEC is overstepping its regulatory authority.

The Implications of SEC’s Action on Crypto Regulation

The agency’s lawsuit is part of a larger crackdown on the cryptocurrency industry. The regulatory body has issued Wells notices, filed lawsuits, and finalized settlements with numerous crypto companies such as ShapeShift, TradeStation, and Uniswap, all operating within the Ethereum and decentralized finance sectors.

Consensys, founded by Ethereum co-developer Joseph Lubin, differs from other agency targets like exchanges such as Coinbase and Kraken. The company primarily develops software, notably the MetaMask self-custodial crypto wallet, enabling users to store, buy, send, and swap tokens.

The agency’s complaint states that Consensys facilitated over 36 million crypto asset transactions through MetaMask, including at least five million transactions involving securities. The regulatory body argues that these activities qualify Consensys as an unregistered broker.

Consensys has criticized the SEC’s actions as part of an “anti-crypto agenda,” accusing the agency of trying to expand its jurisdiction through legal means. The company asserts that the Exchange Commission cannot regulate software interfaces like MetaMask.

Despite facing a fresh lawsuit, Consensys remains resolute in its commitment to challenge the SEC’s regulatory jurisdiction over software interfaces within the Ethereum blockchain, pressing forward with its legal crusade in Texas. A spokesperson for Consensys emphasized the company’s confidence in its legal position and determination to defend against the new case in New York.

Before this legal action, Consensys reported that the Exchange Commission had concluded its inquiry into Ethereum 2.0 without pursuing regulatory measures. The company celebrated this as a victory, though the latest lawsuit shows that the conflict with the regulator is far from over.

The resolution of this legal battle could have significant implications for the cryptocurrency industry. As the Exchange Commission intensifies its scrutiny of crypto firms, the outcomes of these cases will likely shape the future landscape of digital asset regulation in the United States.

Related Readings | Mt. Gox Hack Victims To Receive Over 140,000 Bitcoins In July, Ending 10-Year Nightmare