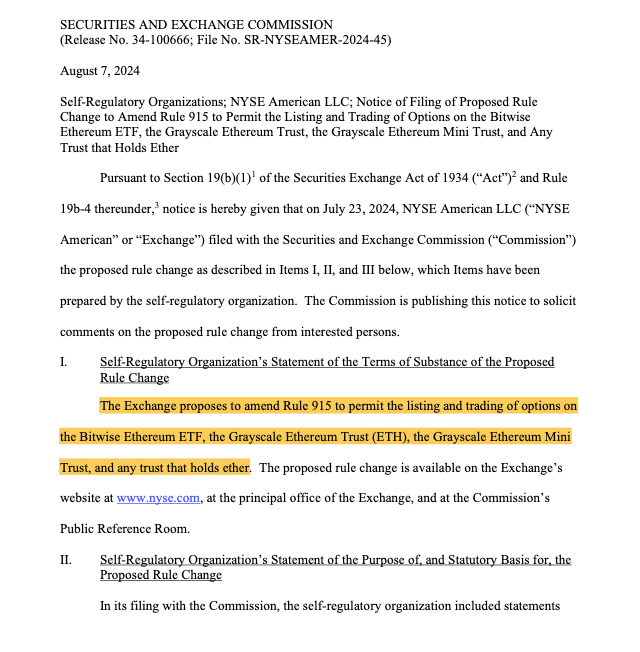

The cryptocurrency market will face a great change as the NYSE American has submitted a request to the Securities and Exchange Commission (SEC) to offer and trade options for three Ether exchange-traded funds (ETFs) by Grayscale and Bitwise. This decision, presented in an August 7, 2024 filing, intends to provide users with more options for exposure to Ether, the cryptocurrency native to the Ethereum network and currently priced at $2,420.

In the proposal, NYSE American pointed out that options trading on the Bitwise Ethereum ETF (ETHW), Grayscale Ethereum Trust (ETHE), and Grayscale Ethereum Mini (ETH) would be a low-cost investment avenue and a strong hedging mechanism. These alternatives would be the key for investors to get the most out of their positions in the ETH products.

NYSE and Nasdaq ETF Moves

The process of rule change approval consists of a 21-day comment period during which stakeholders can submit their views. If the deal goes through, it would be a major victory for Grayscale and Bitwise, as their Ether ETFs would be the only ones on the NYSE American with listed options. This strategy fits the growing need for more complex financial tools in the cryptocurrency market, which aims to attract retail and institutional investors.

Moreover, NYSE American’s request is similar to a filing by Nasdaq on August 6, 2024. Nasdaq is asking the SEC for approval to list options for the BlackRock iShares Ethereum Trust (ETHA), the only Ether ETF on its exchange. This pattern denotes a developing desire of the bigger exchanges to diversify their offers in the fast-changing digital asset environment.

Market Implications and SEC Deliberations

Despite these proactive steps, both exchanges might endure a long wait. The SEC still hasn’t approved options trading for spot Bitcoin ETFs, which started in January 2024 and now handle about $50 billion in assets. In July, the SEC asked for more time to review proposals from options exchanges like Nasdaq about Bitcoin ETF options.

Options play a major role in the work of financial planners and hedge funds, protecting investments from market volatility. For example, the price of Ether dropped by 28% on August 5, 2024. Options also allow for more complex trading strategies, giving a sophisticated toolbox for navigating the crypto markets.

While the SEC is discussing these requests, the crypto community is still optimistic about the expanded trading options, which are viewed as a major step towards developing the cryptocurrency market.

Related Reading | Crypto Market Plunges 13% as $1 Billion Liquidated in 24 Hours