Defunct cryptocurrency exchange Mt. Gox has sparked attention following significant Bitcoin transfers totalling 6,620 BTC, valued at $352.7 million. Arkham Intelligence reveals these funds were moved to an unknown wallet just hours before press time. Reports of a $2.8 billion transaction the previous day have fueled speculation.

Recent data reveals Mt. Gox shifted 6,620 BTC across two transactions, directing 3,493 BTC, worth $340 million, to wallet 1MAXy6…Ez3NQ9 and 126.577 BTC, worth $12.33 million, to wallet bc1qkf…ffm7sf. Market participants speculate these transactions are tied to creditor repayment plans. Analysts warn that such distributions could elevate Bitcoin’s selling pressure.

BTC Resilience Amid Mt. Gox Transfer Concerns

Despite the massive transfers, Bitcoin’s price has shown resilience. CoinGecko data shows BTC is 4.8% lower than yesterday, trading at $87,859. Analyst Min Jung notes that Mt. Gox-related announcements typically dampen market sentiment, though the impact appears muted this time.

Experts attribute the reduced market turbulence to increased maturity and liquidity in the crypto market. Alex Obchakevich highlights the billions in rising capitalization and trading volumes, cushioning the market against abrupt shifts. Furthermore, Mt. Gox’s decision to postpone creditor repayments until 2025 has delayed immediate sell pressure from its transactions.

Marathon Digital’s $850 million convertible note offering for BTC purchases bolstered market optimism. The miner’s move at 0% interest reflects confidence in BTC’s long-term potential, contrasting with fears surrounding Mt. Gox’s transfers. The bullish sentiment supports Bitcoin’s resilience despite heightened liquidation concerns.

Bitcoin’s Price Dips Below $100K

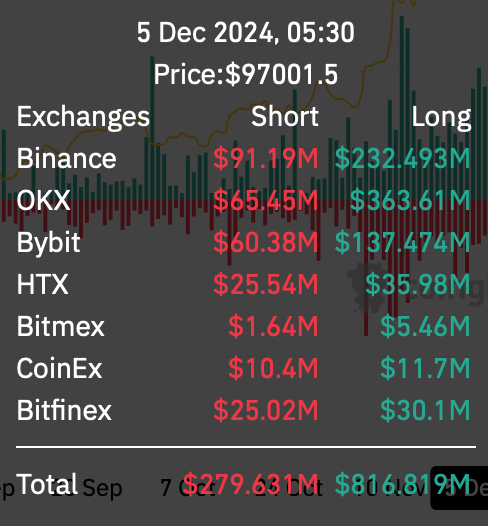

Bitcoin’s price volatility aligns with the crypto market’s broader movements, which recently experienced a flash crash. BTC fell to $98,344 intraday before rebounding near $103K with a 24-hour low of $87,859. Coinglass data revealed over $1 billion in liquidations across crypto markets, exacerbating the turbulence.

Investor sentiment remains mixed as traders navigate Mt. Gox’s recent activity and the market’s broader dynamics. Despite the setbacks, Bitcoin’s ability to recover demonstrates ongoing bullish sentiment. Analysts eye upcoming market trends and external factors shaping Bitcoin’s price trajectory as 2024’s fourth quarter unfolds.

The saga of Mt. Gox continues to intrigue market watchers. While historical transactions triggered instability, today’s mature market environment tempers the effects. Observers remain focused on BTC’s price movements, underlining its potential for resilience and long-term growth amidst mounting external pressures.

Read More: Mt. Gox Transfers 2,570 Bitcoin, Sparking Massive BTC Rally Speculation