Bitcoin reached a historic $100,000 milestone on December 5, marking a significant achievement in crypto history. Despite a lack of momentum in most major global assets and declining liquidity worldwide, Bitcoin’s price surged by 32% over the past month, while other assets such as oil, gold, and the S&P 500 experienced losses.

Bitcoin’s performance amidst declining global liquidity is particularly notable. Unlike other markets, which struggled, BTC’s price reached new heights. Analysts suggest that this surge signals a sustained bull market. The coin’s rally is expected to continue until late 2025, with traders dubbing this phase the “euphoria stage” of the market cycle.

Bitcoin’s price seemed to slow at the end of November, leading some to speculate about sell pressure. However, after some initial downside, Bitcoin’s momentum shifted. The first few days of December revealed substantial liquidations, with $136.41 million in BTC liquidations across exchanges, suggesting a potential market reset.

Whale Activity Driving Bitcoin’s Surge

Bitcoin’s upward momentum slowed at the close of November, with a slight dip early in December suggesting mounting sell pressure and potential liquidations. Over the past 24 hours, BTC liquidations reached $136.41 million, while long liquidations totalled $45.86 million, according to Coinglass data.

CryptoQuant analysis highlights whale activity on platforms like Coinbase Premium and Binance as key drivers of Bitcoin’s bullish run. Strong momentum was noted when the 1-day moving average crossed over the weekly average.

Market observers, citing Delphi Research, point to a predicted cycle for BTC that suggests a correlation with Ethereum (ETH), Solana (SOL), and other major altcoins. Analyst Ignas predicts a “MEGA CRAZY bull run” could follow if Donald Trump’s 2024 presidential win leads to crypto-friendly regulations.

Bitcoin’s rally is supported by increased whale activity, with large holder inflows surging from 102.4 BTC on December 1 to 22,100 BTC by December 3. Although inflows have since tapered, the surge in spot market inflows, which hit $1.07 billion on December 5, signals strong demand.

BTC’s open interest reached a record $65.65 billion, reflecting demand similar to that of the spot market. Additionally, ETF flows saw over $1 billion in positive movements in the last two days, further boosting market sentiment.

Bitcoin’s Bullish Momentum to Continue

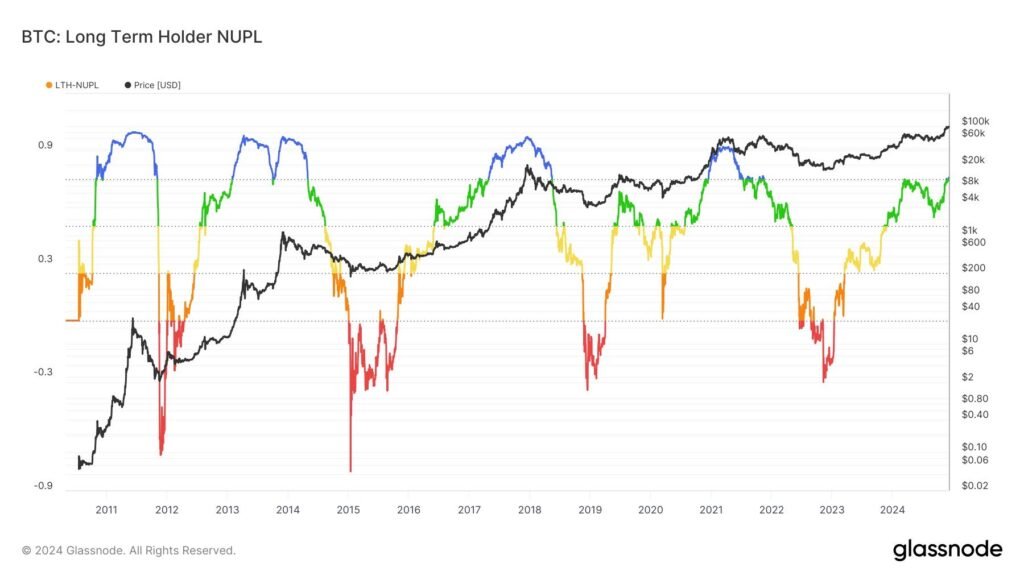

The “euphoria stage” in BTC’s cycle is characterized by long-term holders seeing unrealized profits, as indicated by the NUPL metric. BTC has entered its “euphoria stage,” signalling a potential rally until 2025, according to Quinten François, co-founder of WeRate. In a Dec. 7 X post, he noted: “Bitcoin is entering the euphoria stage. You have a maximum of 12 months before the cycle top.”

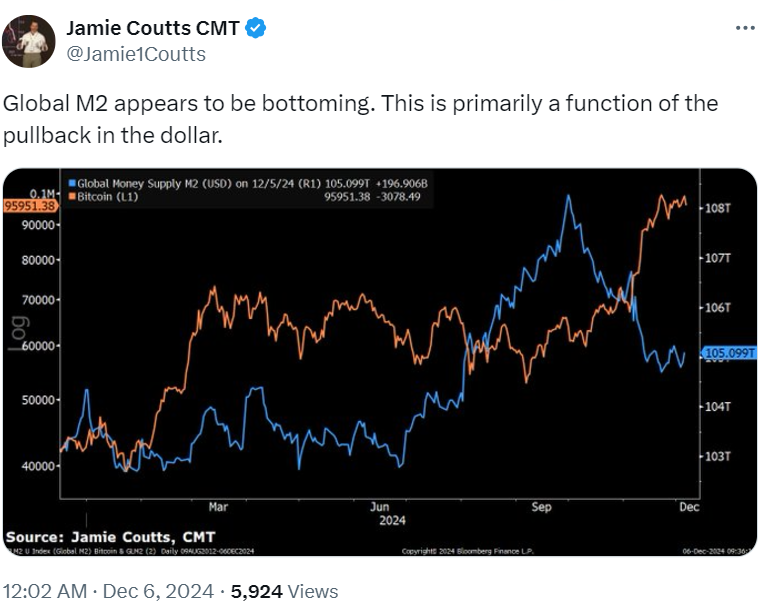

James Coutts, chief crypto analyst at Real Vision, highlighted Bitcoin’s recent all-time highs despite a global liquidity downturn. In his Dec. 6 X post, he stated, “Bitcoin has hit new ATHs amid deteriorating liquidity. If conditions worsen, the rally may be short-lived. However, easing liquidity could lead to further growth.”

Raoul Pal, founder of Global Macro Investor, also supports this outlook. He pointed to a potential bottom in global M2 liquidity as a factor that could extend BTC’s rise. His forecast suggests that BTC could reach over $110,000 before facing any correction.

Bitcoin’s impressive performance, especially in sluggish global asset markets, presents an optimistic outlook for crypto enthusiasts. While challenges remain in the broader economy, BTC’s ability to thrive in such conditions indicates its growing resilience and market appeal.

The long-term holder net unrealized profit/loss (NUPL) metric, used to gauge whether BTC holders are in profit or loss, suggests this phase is underway.

Related Reading: Bitcoin Price Surpasses $100K for First Time In History, CRV Gains 20%, SAND Rises 16%