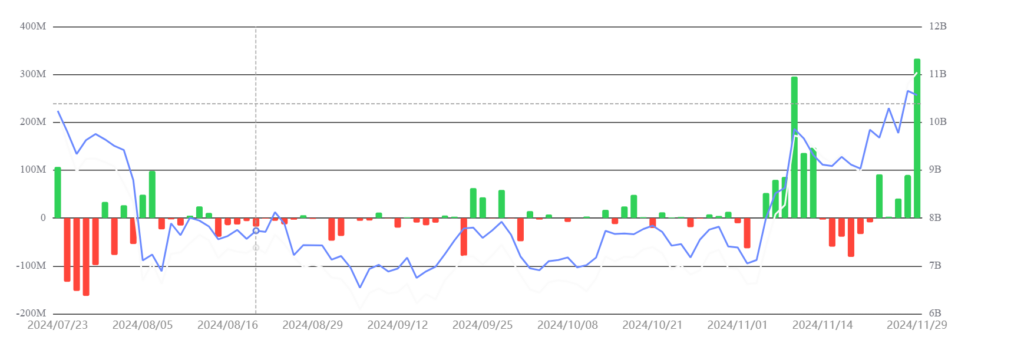

In a turning move, On Friday, the US Spot Ethereum ETF made history in significant inflow. Ether ETF saw $332.92 million in inflow, this is the first time achieved milestone since it was launched. BlackRock Ether (IBIT) led this surge after two days of zero performance. Spot Bitcoin ETF single-day inflow reached $320.01 million on 29 November.

According to Sosovalue, Investors have implanted assets in spot Ether ETF. On November 29, the total net inflow of Ethereum spot ETFs reached $333 million, marking a record high and surpassing Bitcoin spot ETFs ($320 million) for the first time in history. The Ethereum spot ETF with the largest single-day net inflow was the BlackRock ETF ETHA, with a single-day inflow of $250 million. To date, ETHA’s total historical net inflow has reached $2.103 billion.

Ethereum Struggles with Resistance Amid Rising Whale Activity

Ethereum has been consistent at over $3,500 USDT meaning it is performing well in the market. Nevertheless, it is battling rippling resistance around the $3,700 USDT price level. The crypto analyst Rekt Capital claims that Ethereum will only get through the obstacle if it finishes the week strongly by closing significantly higher than this level.

“If this doesn’t happen, Ethereum’s climb to 4,000 USDT might take longer. Analyst Rekt Capital called the recent price movement a ‘perfect rejection’ at the 3,700 USDT level, meaning Ethereum might need more time before it’s ready to break through.”

Ethereum Price up 2.03% over the past 24 hours traded at $3,676.67. ETH Total supply reached 120.44 million, while Ethereum Volume single-day achieved $32.81 billion, up 17.86%.

Ethereum’s future feels more uncertain as large holders, or “whales,” increase activity. Co-founder Jeffrey Wilcke recently moved 20,000 ETH (worth $72.5 million) to Kraken, raising fears of potential selling pressure. Earlier in 2024, Wilcke sold 44,300 ETH ($148 million). While optimism persists for Ethereum’s future, its short-term price faces challenges.

Spot Bitcoin ETF Single-Day inflow Was $320.01 Million

On November 29, the U.S Spot Bitcoin ETF saw $320 million inflow. Blackrock IBIT (ishares) the largest ETF by net assets, led this surge with $137.5 million inflow. To date, IBIT’s total historical net inflow has reached $31.738 billion.

Moreover, Fidelity FBTC had $106.46 million inflow, while VanEck HODL saw $33.1 million inflow. Ark ARKB and Grayscale BTC had $7.8 million and $8.6 million inflow respectevily. Other six ETF had zero inflow. These 12 spot BTC ETFs total net assets reached $105.28 billion, with the net asset ratio of 5.47%.

At the time of writing, Bitcoin (BTC) ‘s price had decreased 0.59% to $96,576.46. The leading coin’s volume was up 4.52% in a single day to $49.02 billion. Many authors, such as Robert Kiyosaki, predict that Bitcoin’s price could reach 100k in 2025.

In recent days, the author of “Rich Dad Poor Dad” has encouraged his followers on X to invest in Bitcoin. The billionaire and Bitcoin investor mentioned that he has always invested in Bitcoin, silver, and gold. He also stated that the dollar is a flawed currency like poor pages.

Related Reading | Bitcoin ETF Sees $103 Million Inflow On Sunday, With Net Asset Ratio Reaching 5.46%