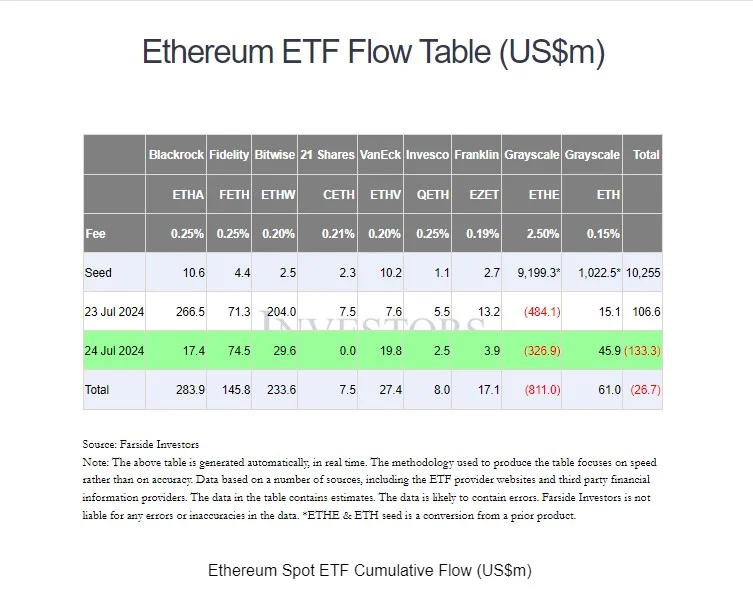

US spot Ethereum exchange-traded funds (ETFs) experienced a decrease in net inflows after a promising start with nearly $107 million. As per information from Farside Investors, investors withdrew approximately $133 million on the second day of trading, signalling a cautious market sentiment.

With $74.5 million in net inflows, Fidelity’s Ethereum Fund (FETH) performed better than BlackRock’s iShares Ethereum Trust (ETHA). On Wednesday, BlackRock’s deposit managed $17.5 million, a significant decrease from its initial performance.

ETHA led with over $266 million inflows on the principal exchange day. Extra inflows from seven other Ethereum ETFs offset surges from Grayscale’s Ether ETF (ETHE) on its presentation, keeping up with general market dependability.

According to information from SosoValue, the ETFs received $106.7 million in net inflows on Tuesday, surpassing managing assets worth $10 billion. Grayscale Ethereum Trust was the only asset to see significant withdrawals on that day, with a total of $484.1 million.

Grayscale Ethereum ETF Significant Surges

Grayscale Ethereum Trust (ETHE) changed into an ETF on Tuesday, causing a net surge of $484.1 million. These outflows were attributed to Grayscale’s higher fees, which market analysts anticipated, although it was the largest ether ETF by assets.

The outflows from Grayscale’s ETHE mirrored the earlier outflows from the Grayscale Bitcoin Trust (GBTC) following the launch of spot Bitcoin ETFs in January. According to analysts, short-term ether prices (ETH) could negatively impact these withdrawals.

Spot bitcoin ETFs saw $655.3 million in inflows on their most memorable exchanging day, as detailed by Farside Financial backers. Even though spot ether ETFs received positive inflows on Tuesday, ether prices fell 1.3% in early trading on Wednesday, but they recovered to a 0.08% decline by 1 p.m. ET.

Grayscale’s ETHE suffered on the second day, losing nearly $327 million, bringing the total outflows for the two days to $811 million. Other ETFs continued to receive net inflows, despite this sharp decline. With $74.46 million in net inflows, Fidelity’s FETH remained the leader, followed by Grayscale Ethereum Mini Trust with $45.93 million.

While the VanEck Ether ETF recorded $20 million in inflows, the Bitwise Ether ETF received almost $29 million. The Franklin Ether ETF and the Invesco Galaxy Ether ETF both experienced gains. On Wednesday, BlackRock’s ETHA managed net inflows of $17.44 million, a significant decrease from Tuesday’s $266.55 million.

Read Also: Ethereum Jumps 5% To $3,300 As SEC’s Imminent Spot ETF Decision Sparks Explosive Bull Run