In a significant move, the U.S. Bitcoin Exchange Traded Fund saw a $353.67 million inflow on Monday. On the other hand, the Ethereum spot ETF had a total net inflow of $24.2306 million on December 2 and continued to have a net inflow for the six following days.

BlackRock’s IBIT, the largest spot bitcoin ETF by net assets, led the inflows with $338.3 million on Monday, according to SoSoValue data. Fidelity FBTC logged a $25.1 million inflow. The other five spot BTC ETFs had zero flow.

Bitcoin Poised For December Surge

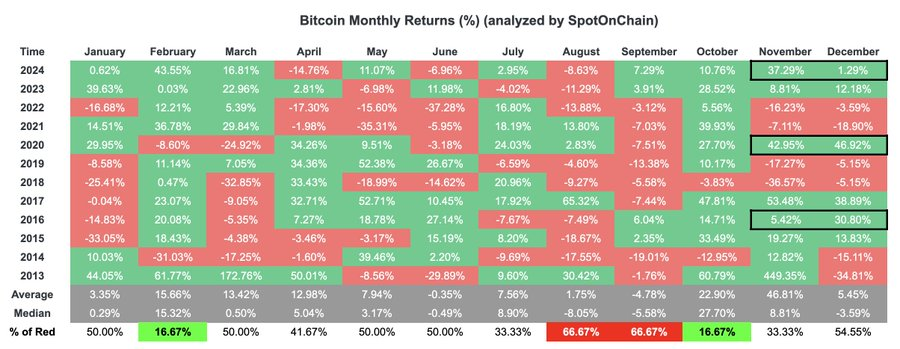

SpotOnChain said Bitcoin’s price increased 37.3% in November 2024 after the U.S. presidential election. Last year, BTC experienced significant upturns after election month in December, with prices ranging from about 30% to 46%.

Analysts predict that BTC might reach a new all-time high of $115,000 this December, following its historical trend of strong post-election performance. This projection aligns with earlier forecasts suggesting BTC could surpass $100,000, boosted by fresh factors fueling investor confidence.

Bitcoin’s performance from 2013 to 2024 differs, but December has often been a strong month, especially in 2020 and 2021. While November and December 2022 saw lower returns, analysts said December remains a month of potential growth, fueling optimism for gains in the weeks ahead.

Bitcoin Price Prediction For 2024 & After

A report from Spot On Chain suggests that Bitcoin’s price is expected to remain unstable, with a 63% chance of reaching $100,000 in the second half of 2024. For May, June, and July 2024, the price is predicted to range between $56,000 and $70,000, but there’s a 48% chance it could drop below $60,000.

Looking further ahead, BTC has a 42% chance of increasing to $150,000 in early 2025, rising to 70% by the end of that year. According to Coinmarketcap, the rate of leading coin 0.19% decreased over the past 24 hours. At the time of writing, the coin was trading at $95,256.74.

Related Reading | Ethereum ETF Surpases Bitcoin ETF, ETH Price Surged 1.70%